Why debt cancellation by the ECB is not the right strategy

Since the outbreak of the Covid-19 crisis, a debate has emerged on whether we should write off public debts owed to central banks. Despite its technical feasibility, debt cancellation is not the first-best proposal worth fighting for.

This article was first published on December 17th 2020 in the context of my previous role as Executive Director at Positive Money Europe.

Since the beginning of the pandemic, a number of economic taboos – starting with the suspension of fiscal rules and the massive expansion of the ECB’s balance sheet – have been broken. Even more creativity will be required to overcome the economic damage caused by the Covid-19 recession and its aftermath.

Over the past few months, a group of French economists and commentators have revived a controversial idea – writing off public debt that has been transferred onto central banks’ balance sheets as a result of quantitative easing (QE). To complement this cancellation, eurozone member states would commit to reinvesting an equal amount of money into long-term, sustainable investments.

The proposal has recently attracted more attention after the President of the European Parliament David Sassoli said that debt forgiveness was “an interesting working hypothesis”.

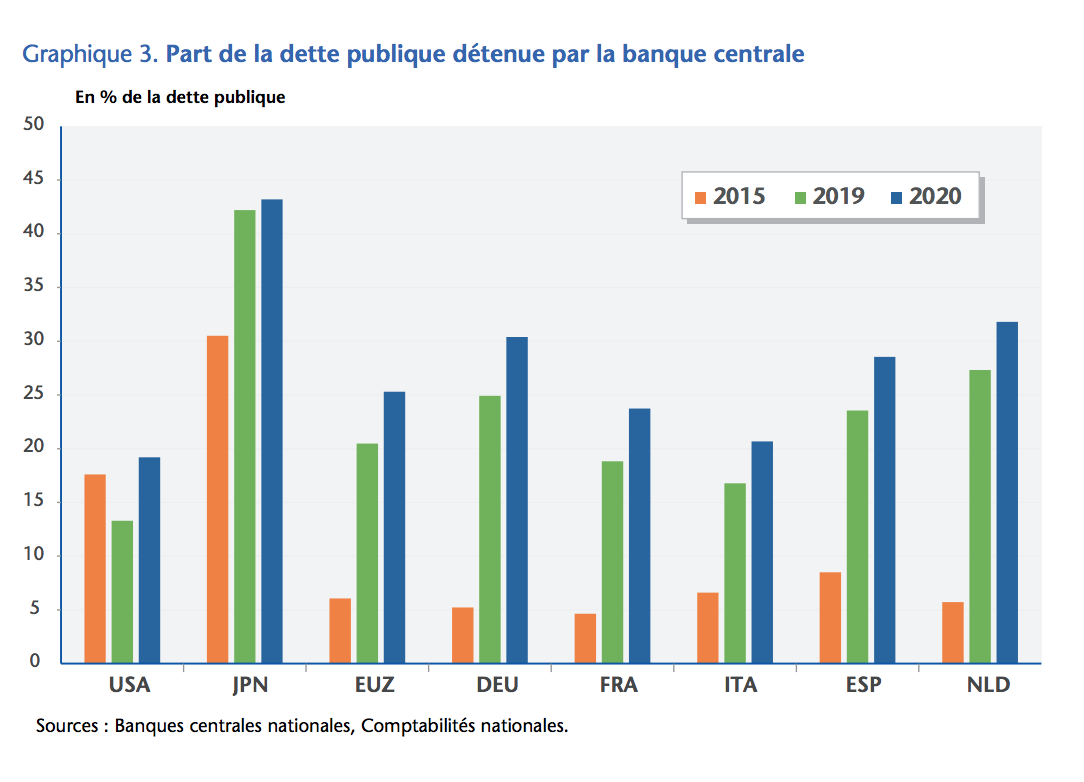

At first sight, the proposal makes sense. Central banks in the Eurozone are currently holding around €2,800 billion of public debt of governments, that is around 30% of public debt in the Eurozone. In practice, national central banks are holding the debt of their country, while only a small percentage (10 to 12%) is held on the ECB’s balance sheet itself.

Share of public debt owned by central banks

Share of public debt owned by central banks

Since central banks are typically owned by their states, they redistribute a large part of the profits made from this public debt throughout their usual distribution of dividends to their governments. So when a country pays back the ECB, a good fraction of money comes back as a central bank dividend.

In other words, we owe 30% of our public debt to ourselves. Which is why we might as well write this debt off. In doing so, governments would see a nominal decrease in their public debt levels and therefore have more “fiscal space” to increase public spending now, instead of going into a deadly spiral of austerity.

However the idea does not please everyone, as several high-level ECB policymakers, including Christine Lagarde, Fabio Panetta and French governor François Villeroy de Galhau, have clearly objected to the proposal.

Positive Money Europe has closely monitored this debate. In this article, we want to explain why the proposal is technically valid but poses many complications from a legal and political viewpoint. After carrying a thorough strategic analysis, we decided to maintain our current focus on other proposals.

Cancelling debt is technically feasible

But first, we want to say loud and clear that we fully endorse the technical side of the proposal.

It is crucial to understand that the proposed debt cancellation is specifically aimed at the 25% of public debt that is owned by central banks, not debt held by private investors and savers. It is, therefore, a very different kind of debt cancellation that was granted to Greece or Argentina a few years ago.

In other words, no pensioners would get hurt under this proposal. Only the central bank balance sheet would suffer. The question which arises next as to what does this imply for the central bank.

Critics often argue that if the central banks agreed to cancel public debt, they would suffer so much loss that they would quickly run into bankruptcy, and require a bailout using taxpayer money.

This objection is however not really convincing. As Christine Lagarde recently pointed out, the ECB “cannot go bankrupt or run out of money”. This is for an obvious reason – the very institution which has the power to create money, by definition, cannot run out of it. Even with negative equity, a central bank can continue to fully operate.

A more nuanced criticism is that debt cancellation by central banks is a zero-sum game. For example, the French treasury’s chief economist Agnès Benassy-Queré explained that the gains from debt cancellation would be offset by a reduction of the central bank’s profit distributions to governments, resulting from the losses incurred on the Eurosystem’s balance sheet

However, the short-term gains from the debt cancellation would be far superior to the small flow of profits that central banks annually distribute to their governments. In the case of France, the government could write off €500 billion of debt (held under both the Pandemic Emergency Purchase Programme and the Public Sector Purchase Programme), while the annual profit given by the Banque de France represents around €6 billion for 2019.

Crucially, it is important to remind ourselves that central banks are not like private companies. Their accounting and balance sheets are purely defined by conventions, and should certainly not be seen as absolute legal or economic constraints. Because of this, instead of outright cancellation, we may for instance want to convert the sovereign bonds into zero-coupon perpetual bonds, sparing the ECB’s accounting department the trouble of dealing with losses.

We therefore completely agree that cancellation of QE debt is technically feasible. But while accounting rules of ECB may be more flexible than one might think, the ECB still operates under rather strict constraints of EU law.

Legally impossible, politically complicated

Thus, we disagree with the view that it would be legal for the ECB to decide unilaterally to cancel debt from governments. It is true that Article 123 of the Treaty on the Functioning of the European Union, when referencing the monetary financing prohibition, does not explicitly envisage the case of public debt cancellation. But it is nevertheless clear that the proposal, by its very intention, goes against the spirit of the EU Treaty. If anything, there is jurisprudence (see Accorinti and Nausicaa) where the EU Court of Justice backed the ECB’s decision not to take part in the Greek debt restructuring programme of 2012 (although for the wrong reasons).

Of course, proponents of debt cancellation are right to argue that the monetary financing prohibition has become an obsolete rule when the risk of inflation is nowhere to be seen. Unfortunately, when it comes to Court decisions, economic arguments rarely match legal ones.

Changing this state of affairs would require enormously strong bargaining power in order for unanimity to be reached by the European Council for Treaty change. In a slightly more optimistic scenario, an implicit agreement between EU heads of state to reinterpret or curb EU rules, with the ECB’s consent, might do the trick.

Given the strong political capital required to pass such a proposal, the main question is whether the gains would be worth the effort? Unfortunately, we do not think so.

Not so obvious economic gains

According to their advocates, unless we cancel debt, policymakers will impose austerity across the eurozone at the end of the crisis, to pay back the huge amount of debt created due to Covid-19. To kill two birds with one stone, they want member states to commit to investing the equivalent of the debt write-off for climate change and the green transition.

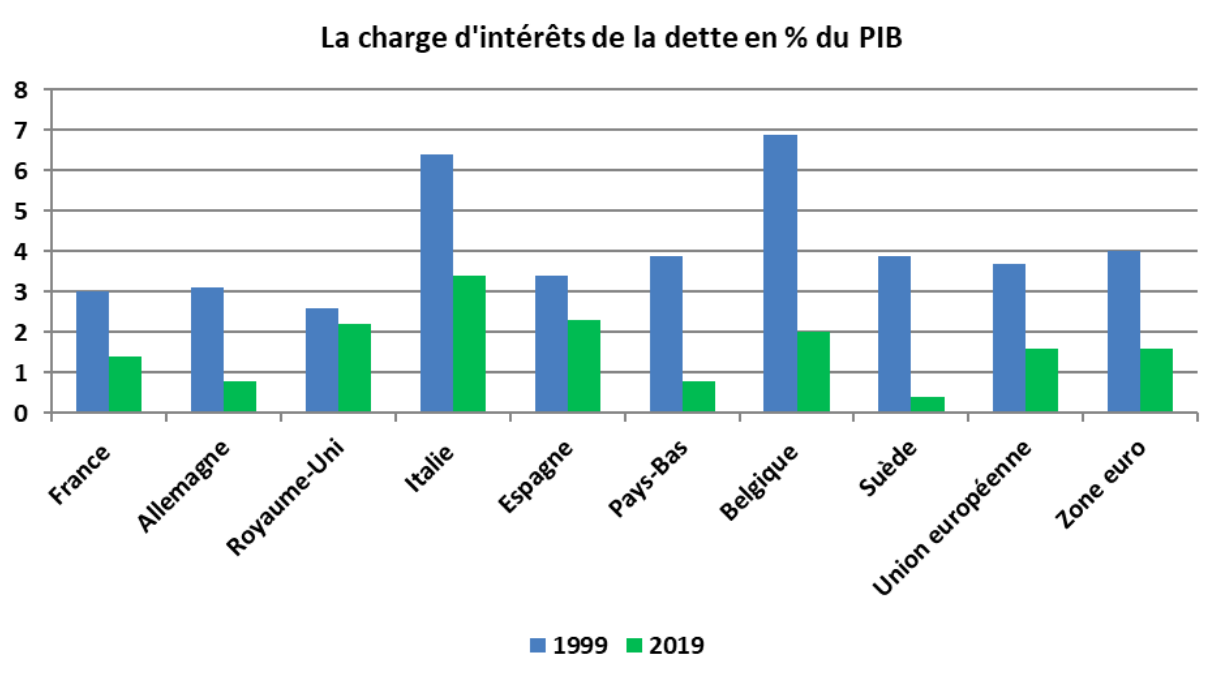

But today European governments – even Greece – are borrowing money at negative interest rates. This means that investors are ready to lose a bit of money to hold sovereign debt (instead of losing even more money if they parked their reserves at the ECB deposit facility). In effect, while government debt has increased considerably, the cost of servicing this debt has been going down.

Public debt cost as % of GDP

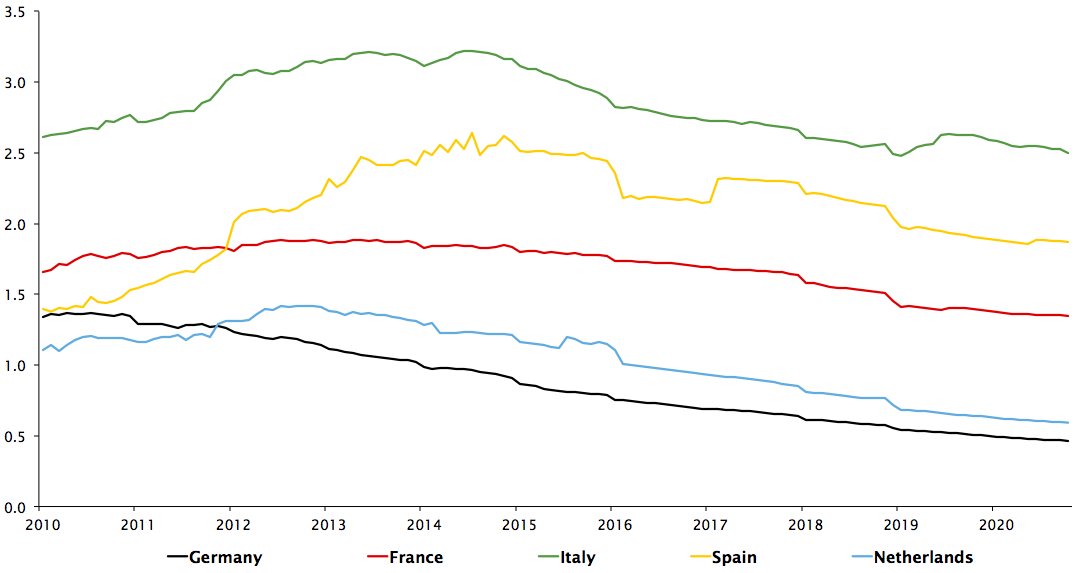

Debt service due in two years on government bonds, % of GDP

Source: ECB Statistical Data Warehouse. Note: Government bonds with 1 to 2 years maturity, debt service without principal, https://sdw.ecb.europa.eu/reports.do?node=1000005712

In this context, although cancelling debt may provide an additional fiscal windfall, it is unfair to present it as an absolutely necessary precondition for investing more in the climate transition. In fact, there is an unprecedented consensus among economists to say that public debt is a non-existing problem today.

This is also why prominent academics have proposed to revise key fiscal indicators, for example by looking at debt-service to GDP instead of misleading debt-to-GDP indicators. By analyzing flow-to-flow dynamics, instead of stock (debt) to flow (GDP), such indicators would do a better job at revealing the government’s debt sustainability.

In this context, although there would be additional gains from a debt cancellation plan, they would not be as automatic and significant as one may think at first sight. There are also some risks that the plan would not work as expected.

Indeed, as pointed out by OFCE researchers, depending on how the debt cancellation is organised and communicated, all sorts of irrational behaviours could jeopardise the plan. Fear and lack of trust from private investors that after cancelling debt from central banks, they may be next on the line, is just one example of this. Similarly, (irrational) fears of inflation may cause investors to demand higher yields. If this were to happen, the immediate reduction in debt stock would be offset by an increase in the borrowing cost of new debt issuance.

Proponents of the ECB debt cancellation campaign are aware of this reality, but they are concerned that the favourable borrowing conditions will not last forever. If and when central banks start raising interest rates, this would bring austerity back with a vengeance. While they are right to flag this potential risk, it would still be a missed opportunity not to take advantage of the current negative interest rates to invest in long term investments. Doing so now would in fact increase the chance of success of bringing our economy towards a path of sustainable growth, which could in effect make debt cancellation unnecessary.

A better strategy

Positive Money Europe certainly wants to be at the forefront of new radical ideas, in particular on how the ECB can better use its money creation power to support society’s interests. We share the same goal of the proponents of debt cancellation: we need to make sure Europe avoid going back into the self-defeating austerity ideology that almost killed the Eurozone in 2010.

The debt cancellation campaign has positively contributed to raising public awareness on the powerful role the ECB can play in this endeavour. But a lot more work is still needed to change public perception on public debt, starting with the revision of fiscal rules and debunking the belief that governments are like households (they are not).

For a campaign organisation like Positive Money Europe, it is critical that we always find the best way of achieving concrete change, making the best use of the limited resources that we have.

The pivotal question is: if today progressive forces had the bargaining power needed to revisit the EU Treaty, should debt cancellation be our first priority?

Our conclusion is clear. Instead of one-shot debt relief, we would rather fight for permanent long-term changes such as a complete rewriting of the ECB’s statutes, including a revision of the monetary financing prohibition and the full revamp of the EU’s fiscal rules. Debt relief from the ECB would come as icing on the cake.

We do not shy away from proposals requiring Treaty change. As we said in the past, we believe Treaty change will inevitably be on the table in the coming years, and Positive Money Europe’s team is working hard to build a powerful movement capable of bringing this a long-term change. However, all our hopes cannot rely upon this remote and hypothetical possibility.

All in all, the proposal to cancel debt held by central banks makes sense from a technical perspective, and should certainly be debated further. If Europe fails to deliver a strong and fair post-Covid19 recovery, the proposal would certainly be a useful “last resort” policy option. But our strategic analysis reveals that the efforts required to win such campaigns would be very high, while its potential gains are uncertain and smaller than one may initially think. This is why debt cancellation cannot be our “first best” priority for now.

There are other, more effective routes to win progressive macroeconomic policies in the Eurozone. Positive Money Europe’s campaigns efforts are currently focusing on key issues such as aligning the ECB’s monetary policy with the EU’s climate goals, and creating political room for “helicopter money”. Next year, we also hope to start new campaigns to fight post-Covid-19 over-indebtedness in SMEs and households, and we wish to increase momentum for a progressive fiscal framework. If we keep focused and grow our movement, we stand a real chance to win concrete victories in the next few months.

This post is also available in: French